AI VISIBILITY RANKING: Airlines

Nov 4, 2025

AI Visibility Report: Which Airlines Win When Travelers Ask AI for Recommendations

The new travel agent isn't human and it's already making decisions worth billions.

Here's what's happening while airlines obsess over Google rankings and Instagram ads: 40% of travelers worldwide are now asking ChatGPT, Gemini, and Perplexity which airline to fly. Not browsing Kayak. Not comparing on Expedia. Just chatting with AI and booking whatever it recommends.

Among millennials and Gen Z, that number jumps to 60%. For these travelers, AI isn't a novelty it's the default research method. The question "Which airline should I use?" gets answered before they ever see your website.

This shift is massive. The AI travel planning market was valued at $544 billion in 2024 and is projected to hit nearly $1.5 trillion by 2032. Airlines that don't show up in these AI conversations aren't just missing marketing opportunities. They're becoming invisible at the exact moment purchasing decisions get made.

GetMentioned's latest benchmark reveals which North and Latin American carriers are winning this battle and which are getting left behind.

Who's In the Fight

The analysis covers twenty-plus carriers spanning the entire commercial aviation spectrum: ultra-low-cost disruptors (Spirit, Frontier, Allegiant), regional players (Porter, Interjet, Copa), and legacy giants (Delta, American, United).

Also tracked: WestJet, Aeromexico, Volaris, Air Canada Rouge, Hawaiian, Avelo, Breeze, Sun Country, Southwest, Alaska, and JetBlue.

The mix matters. AI doesn't care about your airline's legacy or ad budget. It cares about what people say about you online and which sources it trusts.

Six Questions That Determine Everything

GetMentioned tracked how often airlines appeared when AI systems answered six critical traveler questions. These aren't abstract scenarios. They're how real people actually talk to AI:

Business Class Comfort

• "Which airline offers the best business class for comfort and tech-savvy travelers?"

• "Affordable business class airline with loyalty rewards and free inflight Wi-Fi?"

Loyalty Programs That Actually Matter

• "Which airline offers the best frequent flyer programme for remote workers?"

• "Recommend an airline with eco-friendly choices and premium rewards."

Luggage Policies (Because nobody likes surprise fees)

• "Which airline has the best luggage policy for affordable flights with digital booking?"

• "Recommend a U.S. airline with generous luggage allowance and premium cabin options."

Overall Reputation

• "Which U.S. airlines do travelers recommend for comfort, price, and service?"

• "What are the top alternatives to legacy airlines for digital-first travelers?"

Budget Travel

• "What are the best low-cost carriers combining affordability with premium features?"

• "Recommend budget-friendly airlines with good digital comfort for short routes."

Sustainability (Gen Z is watching)

• "Which is the most sustainable U.S.-based carrier?"

• "Recommend affordable eco-friendly airlines for Gen Z travelers."

These categories represent the moments where brand preference forms. Answer them well in AI systems, and you're shortlisted. Answer them poorly or not at all and travelers never hear your name.

Where AI Gets Its Opinions

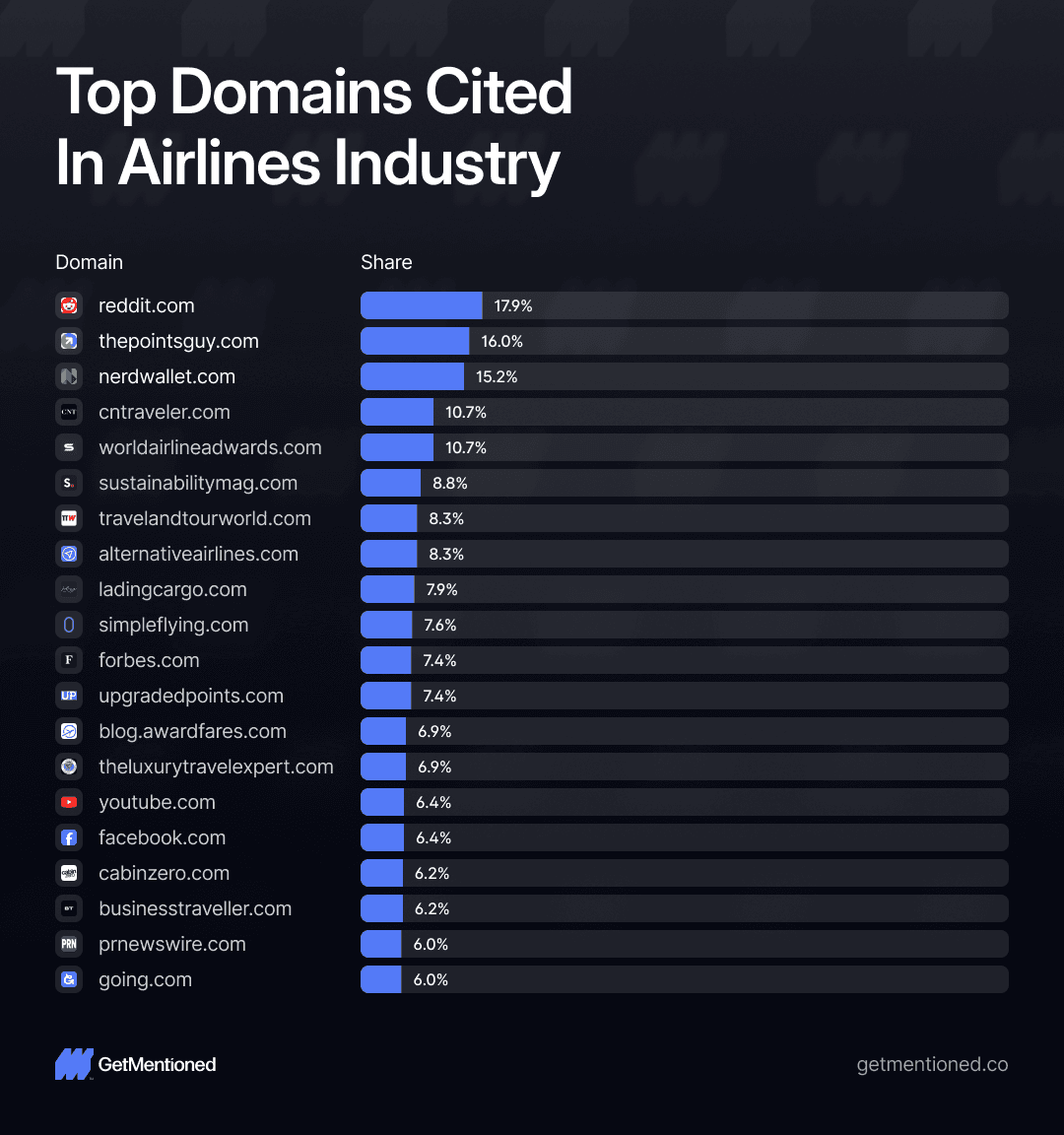

AI models don't pull recommendations from thin air. They synthesize what they've learned from trusted sources. The top domains shaping airline visibility reveal something fascinating:

Reddit (17.9%) dominates above all other sources. Real travelers sharing honest experiences carry enormous weight with AI systems. Travel-focused sites The Points Guy (16.0%) and NerdWallet (15.2%) follow closely, offering expert perspectives that AI systems trust.

Industry publications matter too: CNTraveler (10.7%), World Airline Awards (10.7%), Sustainability Mag (8.8%), and Travel and Tour World (8.3%) all shape AI recommendations. Alternative perspectives from AlternativeAirlines.com (8.3%) and cargo industry insights from Lading Cargo (7.9%) add diversity to AI's knowledge base.

Traditional media maintains influence: Forbes (7.4%), YouTube (6.4%), Facebook (6.4%), and various travel blogs and points sites round out the top sources. Even specialized forums like Simple Flying (7.6%) and Business Traveller (6.2%) contribute to AI's understanding.

The takeaway? AI trusts peer conversations as much as maybe more than professional journalism. Reddit alone accounts for nearly 18% of all sources cited. Your press releases won't cut it. You need people genuinely talking about you in the right places.

Here's where it gets more complex: These sources represent overall visibility patterns, but AI doesn't treat every topic the same way. When travelers ask about business class, AI pulls heavily from premium travel blogs and frequent flyer forums. Sustainability questions? AI leans on environmental publications and corporate responsibility reports. Budget travel queries trigger different sources entirely deal sites, budget travel communities, and cost-comparison platforms.

This means airlines can't win with a one-size-fits-all content strategy. You need presence across multiple source categories, each tailored to the specific questions travelers ask. Dominating Reddit won't help if AI pulls sustainability rankings from sources you've never engaged with. Strong coverage in legacy media won't matter for budget travel queries if you're invisible in deal-hunting communities.

The Shocking Overall Results

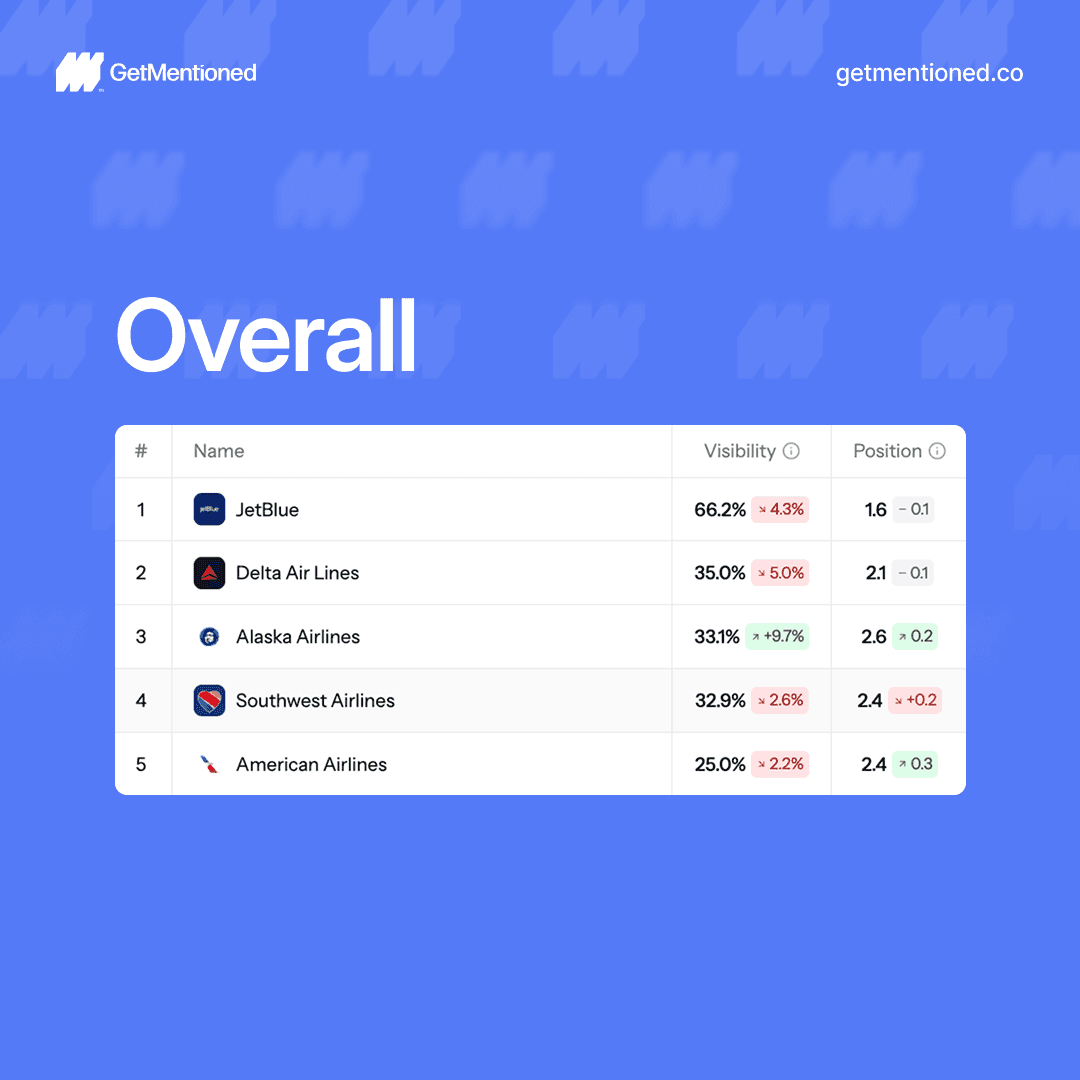

When all topics were aggregated, one airline demolished the competition:

JetBlue appeared in 66.2% of AI responses. Not first place domination. Despite a 4.3% decline from previous measurements, JetBlue still commands nearly two-thirds of all AI recommendations.

Delta took second at 35.0% (down 5.0%), followed by Alaska at 33.1% (up 9.7%) the only top-five airline showing significant growth.

Southwest (32.9%) and American (25.0%) round out the top five, with Southwest down 2.6% and American down 2.2%.

Everyone else? Mostly invisible to AI systems.

Topic by Topic: Where the Battle Is Won and Lost

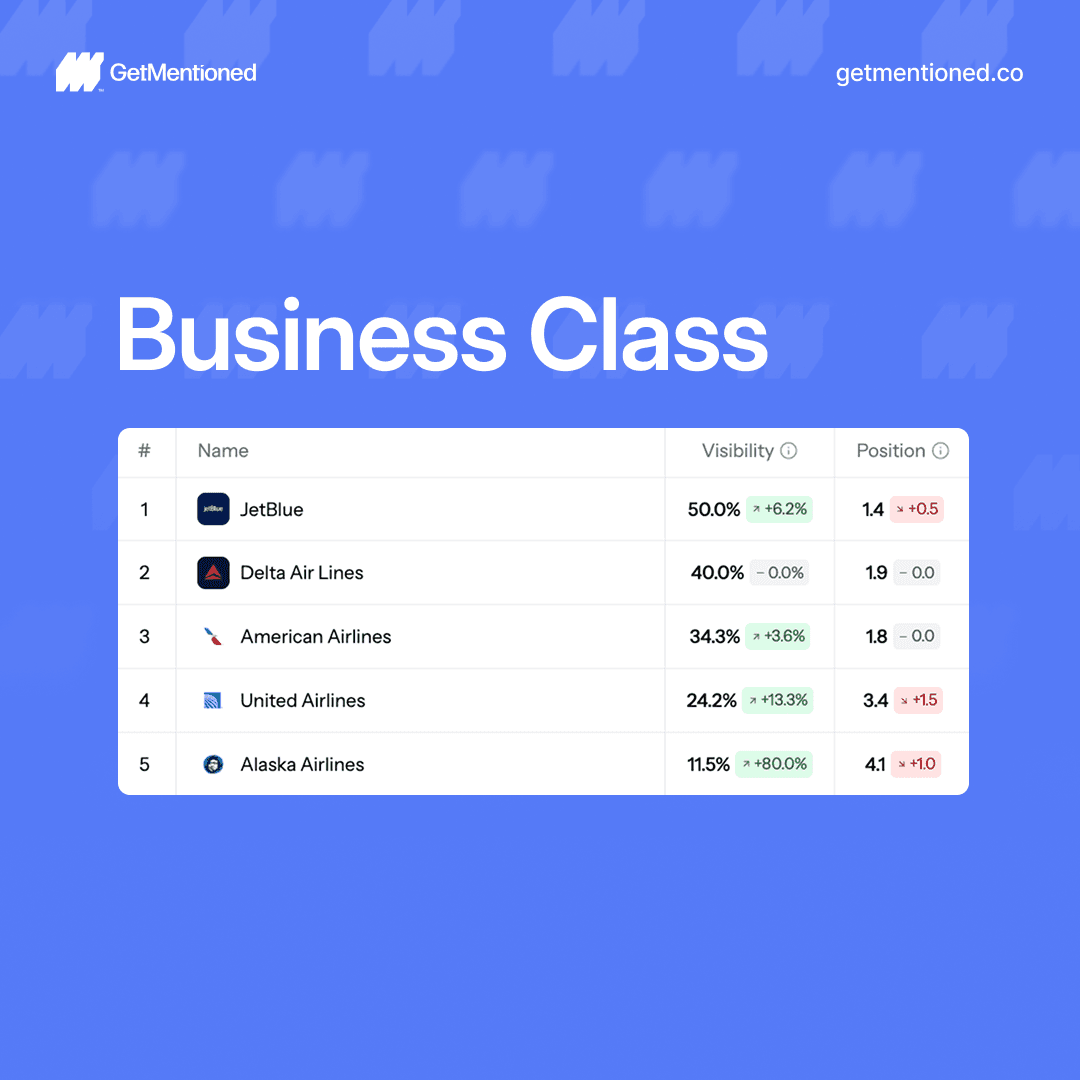

Business Class

JetBlue dominates at 50.0% (up 6.2%), appearing in half of all business class recommendations outperforming legacy carriers that have spent decades building premium cabins. Delta (40.0%) holds steady with no change, while American (34.3%) shows growth at up 3.6%.

United (24.2%) and Alaska (11.5%) round out the top five, with United up 13.3% and Alaska showing explosive 80% growth despite its lower overall visibility.

Why this matters: Premium travelers are high-value customers. If AI doesn't recommend you for business class, you're losing revenue, not just bookings.

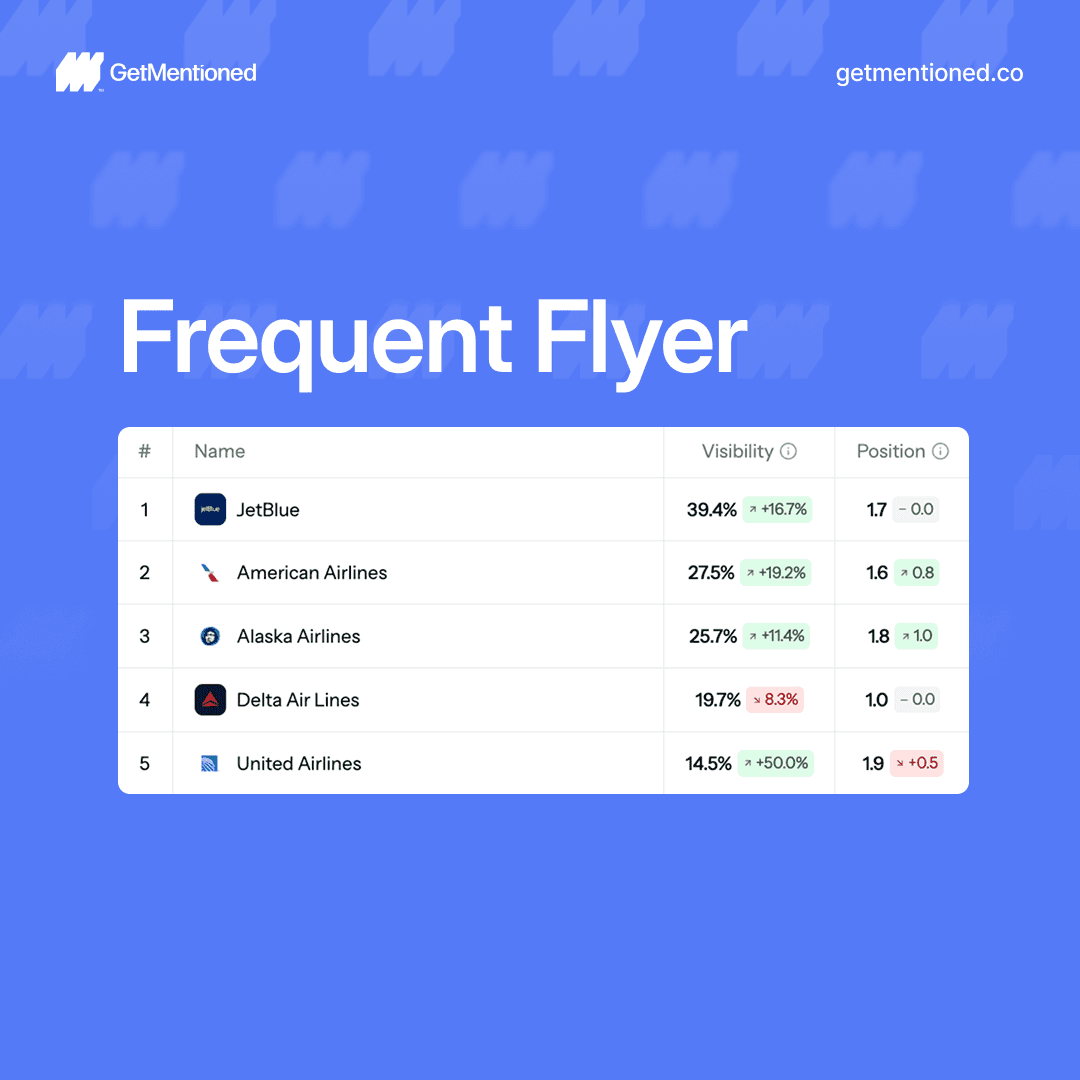

Frequent Flyer Programs

JetBlue leads at 39.4% (up 16.7%), nearly 12 percentage points ahead of second place. American follows at 27.5% (up 19.2%), with Alaska close behind at 25.7% (up 11.4%).

Delta (19.7%) shows a decline of 8.3%, while United (14.5%) demonstrates explosive 150% growth despite maintaining fifth position.

The insight: Loyalty programs create repeat customers. AI is steering people toward specific programs before they've taken their first flight with you. JetBlue's TrueBlue program dominates the conversation, while legacy carriers show mixed results.

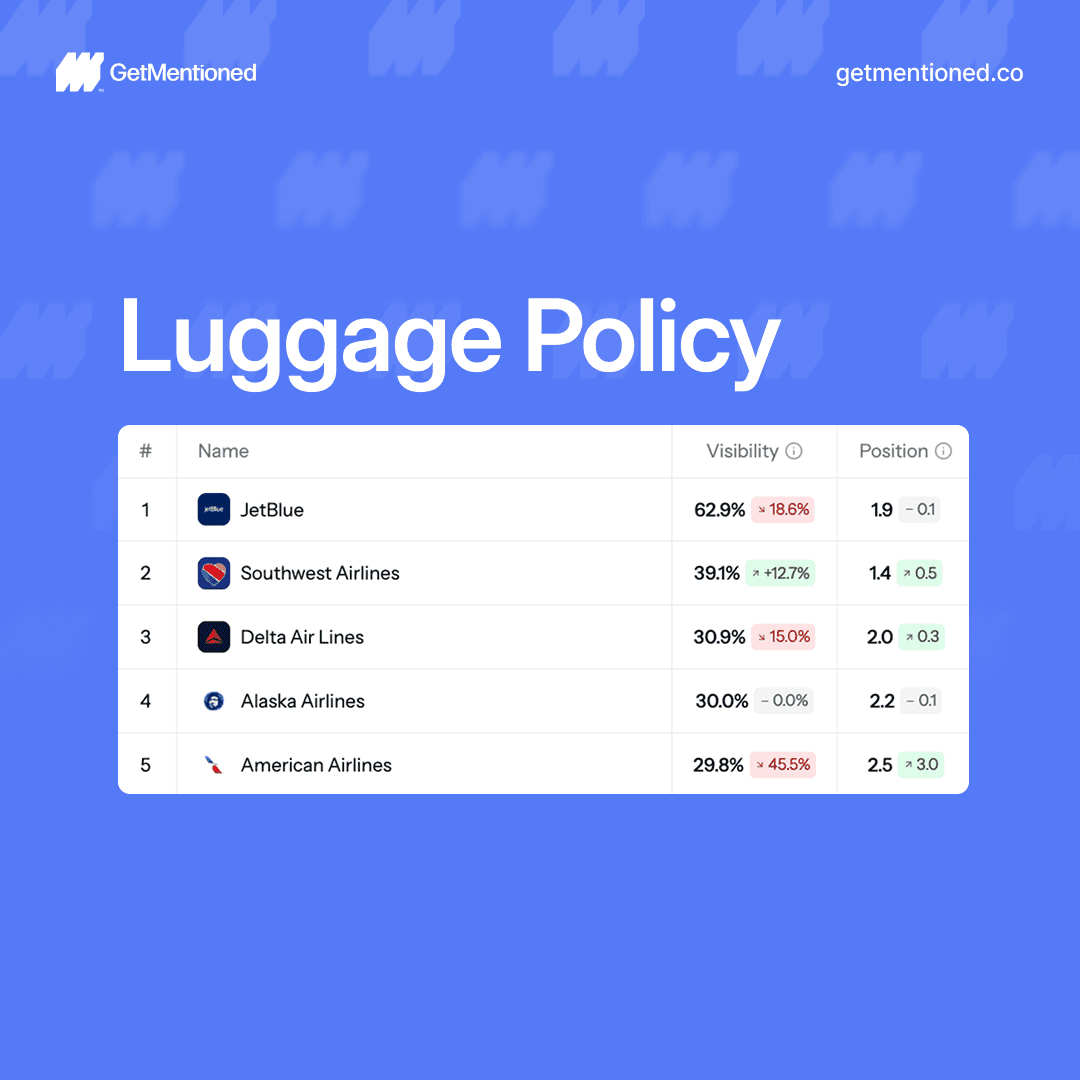

Luggage Policy

JetBlue (62.9%) dominates this category despite an 18.6% decline, appearing in nearly two-thirds of luggage policy recommendations. Southwest claims second place at 39.1% (up 12.7%) proof that its iconic "bags fly free" message continues to resonate in AI-mediated conversations.

Delta (30.9%) shows a significant 15.0% decline, while Alaska (30.0%) holds steady with no change. American (29.8%) rounds out the top five with a steep 45.5% decline.

Translation: Clear, generous policies get remembered. Hidden fees get you skipped. Southwest's simple message continues to win mindshare, while airlines with complex fee structures are losing ground.

Best Opinions

JetBlue absolutely crushes this category at 85.7% (down 6.7%), appearing in more than four out of five general airline recommendations. Delta maintains strong favorability at 55.1% (up 2.4%), while Southwest (42.6%) holds steady with no change.

Alaska shows impressive growth at 40.3% (up 11.0%), suggesting rising brand trust among travelers. American (27.5%) rounds out the top five with a 6.3% decline.

The pattern: When people ask AI for general recommendations without specific criteria, JetBlue shows up 86% of the time. That's not marketing. That's mindshare. The gap between JetBlue and every other carrier in this category is massive over 30 percentage points to second place.

Cheapest Flights

JetBlue utterly dominates at 94.1% (up 13.3%), appearing in virtually every budget flight recommendation. Southwest follows at 76.5% (up 26.7%), showing massive growth in affordability conversations.

Alaska (42.0%) demonstrates explosive 33.3% growth, while Delta (34.3%) shows a 3.3% decline. Spirit Airlines (25.0%) finally appears in the rankings despite a 34.2% decline.

Here's what's wild: Spirit and Frontier, airlines built entirely on ultra-low fares, barely register. AI sees JetBlue and Southwest as better value propositions balancing price with quality.

The lesson: "Cheap" isn't enough. AI recommends airlines that offer the best overall deal, not just the lowest sticker price. JetBlue's near-universal presence in budget queries shows that travelers (and AI) prioritize value over rock-bottom pricing.

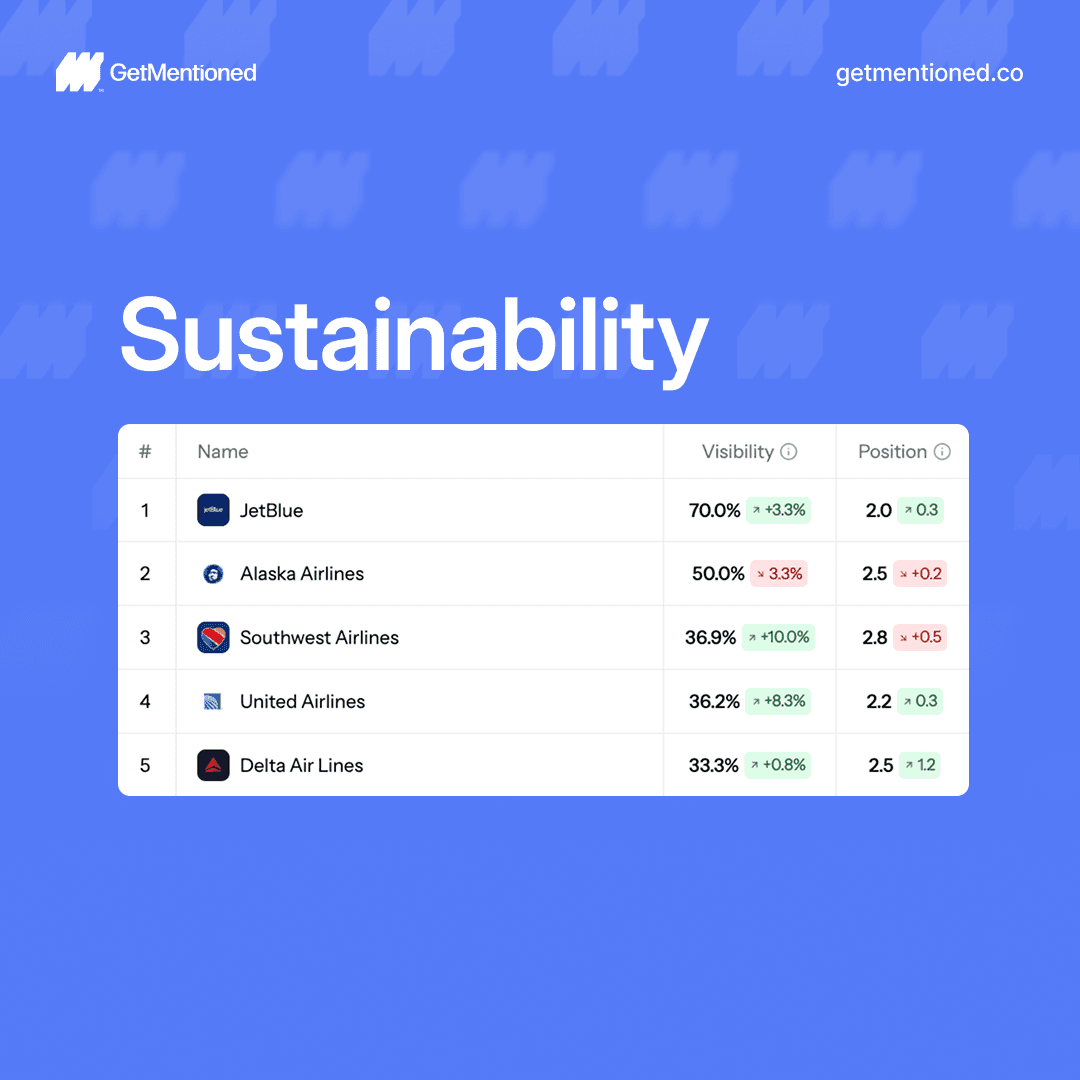

Sustainability

JetBlue (70.0%) leads with a 3.3% increase, recognized as the sustainability leader in seven out of ten AI recommendations. Alaska holds strong second at 50.0% (down 3.3%), appearing in half of all sustainability queries.

Southwest (36.9%) shows healthy 10.0% growth, while United (36.2%) demonstrates strong 8.3% growth. Delta (33.3%) rounds out the top five with modest 0.8% growth.

With 70% of travelers saying they're planning to use or already using AI for trip planning rising to 81% among families and younger travelers prioritizing environmental impact, sustainability messaging is becoming a critical differentiator. JetBlue's commanding lead suggests its environmental initiatives are resonating in AI-mediated conversations, while all top-five carriers show positive or stable trends indicating growing importance of sustainability in airline selection.

What JetBlue Gets Right

JetBlue's dominance isn't accidental. The airline has been a social media pioneer for over a decade, building the kind of authentic, conversational presence that AI systems now amplify.

JetBlue limits its social communications to select platforms that suit specific goals: Facebook for content and promotions, Twitter for customer service. This strategic focus creates depth, not just reach.

The airline maintains a consistent, light-hearted voice across all communications keeping tweets to competitors as friendly and upbeat as those to customers. That consistency signals authenticity to both humans and algorithms.

JetBlue's social team monitors keywords and hashtags to respond to customers who mention the brand even without tagging it. They're not waiting to be summoned. They're actively listening.

Result? Over 2 million Twitter followers, 1.17 million Facebook likes, and most importantly millions of organic conversations that feed directly into AI training data.

The airline also invested early in personalization and omnichannel marketing, creating experiences that people want to share. When travelers have good experiences and talk about them online, AI learns. When they have bad experiences and don't talk about them? AI never knows.

What This Means For Every Airline

Delta, Southwest, and Alaska maintain strong positions but trail JetBlue significantly. They're visible but not dominant.

American and United appear consistently across categories without commanding any of them. They're in the conversation, but AI isn't enthusiastically pushing them to travelers. That's a problem when 83% of travelers say they're more likely to book when AI-enhanced services are offered.

Budget carriers like Spirit, Frontier, and Allegiant barely register despite price-focused branding. AI isn't just repeating ad copy. It's synthesizing reputation and these airlines have a reputation problem AI is faithfully reflecting.

The Uncomfortable Truth

The AI tourism market is projected to hit $13.38 billion by 2030, up from $2.95 billion in 2024 a 353% increase in six years.

This isn't a trend. It's a fundamental restructuring of how travel decisions get made.

For the past two decades, airlines have optimized for Google. They've fought for position one in search results, poured money into SEO, and measured success in keyword rankings.

That playbook is becoming obsolete.

AI doesn't serve ten blue links. It serves one answer. Either you're in that answer, or you don't exist.

How to Win the Invisible Battle

Stop thinking like a marketer. Start thinking like a conversation partner.

AI builds recommendations from what real people say in authentic contexts. That means:

Earn mentions in communities, not just media. Reddit threads and FlyerTalk discussions carry as much weight as Forbes articles. Maybe more.

Make your policies clear and generous. AI remembers Southwest's baggage policy because it's simple and good. Complex fee structures get you filtered out.

Be genuinely responsive on social. JetBlue's dominance stems partly from years of authentic engagement. AI learned that JetBlue listens. That reputation now precedes you in every AI conversation.

Create experiences people want to share. Press releases don't train AI models. Passenger stories do.

Prioritize consistency over virality. One viral moment means nothing. Years of steady, authentic presence means everything.

The Stakes

Airlines that master AI visibility won't just appear in more searches. They'll be recommended by a trusted advisor that travelers consult before they even know which airlines exist.

Airlines that ignore this shift will watch market share evaporate as travelers book flights they never knew about because AI never mentioned them.

The conversation is already happening. The recommendations are already being made. The question isn't whether AI will shape travel decisions.

The question is whether your airline will be part of the answer.

7-day free trial

Setup in 5 minutes

No credit card required