MARKET REPORT: Streaming Services

Dec 9, 2025

Executive Summary

The streaming industry is entering a new era of discovery. With over 200 streaming platforms competing for viewer attention and 58% of consumers now using generative AI tools instead of traditional search engines for product recommendations, visibility in AI-generated responses has become a critical competitive advantage.

This report analyzes how major streaming services perform when consumers ask AI assistants questions like "What's the best streaming service?" or "Which platform has the biggest content library?" Our findings reveal significant disparities in AI visibility that could reshape the competitive landscape of the $233 billion streaming market.

Key Findings:

Netflix dominates overall AI visibility with 69.7% visibility and a 1.5 average position across all prompts

Category-specific positioning varies dramatically - platforms that lead overall may disappear entirely in specialized queries

Sports streaming has a completely different competitive set - YouTube, Peacock, and Sling TV replace traditional leaders

Tech publications and Reddit drive AI recommendations, with PCMag (26.9%) and Reddit (22.8%) being the most influential sources

Why AI Visibility Matters for Streaming Services

The way consumers discover and choose streaming services is fundamentally changing. According to recent research:

71% of consumers want generative AI integrated into their shopping experiences (Capgemini, 2025)

58% have replaced traditional search engines with AI tools for product and service recommendations

39% of consumers already use AI for online shopping, with 14% more planning to adopt it soon (Adobe, 2025)

66% of frequent shoppers regularly use AI assistants like ChatGPT to guide purchase decisions (Yotpo, 2025)

80% of what Netflix users watch is driven by AI-powered recommendations - the same principle now applies to how users choose their streaming service

With ChatGPT alone reaching 800 million weekly active users and AI referral traffic growing 10x since July 2024, streaming services that fail to appear in AI-generated recommendations risk becoming invisible to a growing segment of consumers.

The streaming market's intense competition - with 42% of subscribers regularly churning between services - makes AI visibility even more critical. When a potential subscriber asks an AI assistant "What streaming service should I get?", being mentioned (or not) can directly impact subscription decisions.

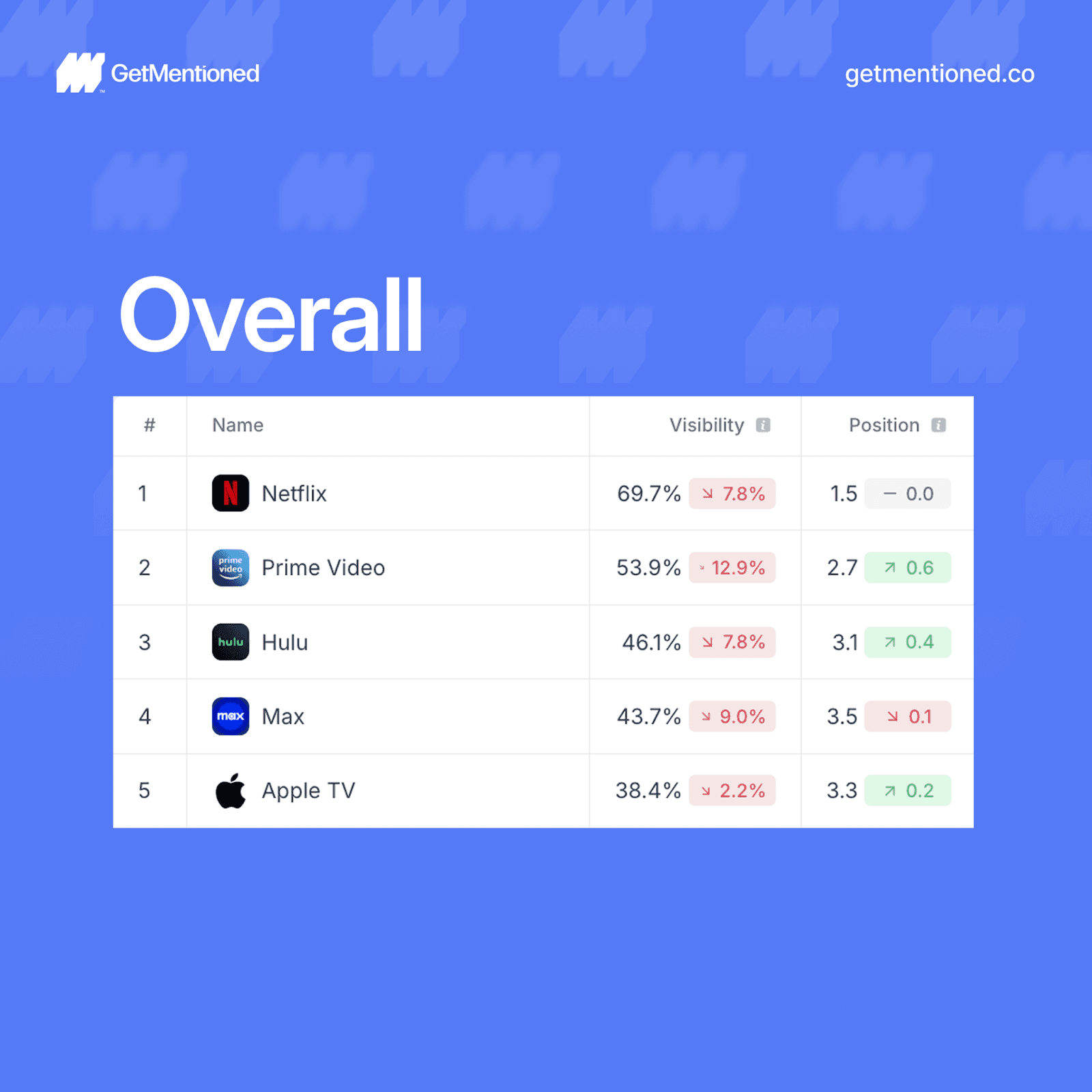

Industry Ranking Overview

Key Insights

Netflix holds clear leadership. With 69.7% visibility and an average position of 1.5, Netflix appears in more than two-thirds of AI responses about streaming services and typically ranks first or second when mentioned.

Prime Video secures second position. At 53.9% visibility and 2.7 average position, Prime Video maintains strong presence but trails Netflix by nearly 16 percentage points.

Hulu, Max, and Apple TV form a competitive middle tier. These three platforms cluster between 38-46% visibility, with relatively similar average positions (3.1-3.5), creating a competitive battleground below the top two.

Apple TV has better positioning than its visibility suggests. Despite ranking #5 in visibility (38.4%), Apple TV's average position (3.3) is better than Max (3.5), indicating that when Apple TV is mentioned, it tends to rank higher.

The Visibility Gap

The gap between Netflix (69.7%) and the fifth-ranked Apple TV (38.4%) is 31.3 percentage points. This means Netflix appears in AI recommendations nearly twice as often as Apple TV. For a potential subscriber using AI to choose a streaming service, this visibility disparity significantly impacts which services enter their consideration set.

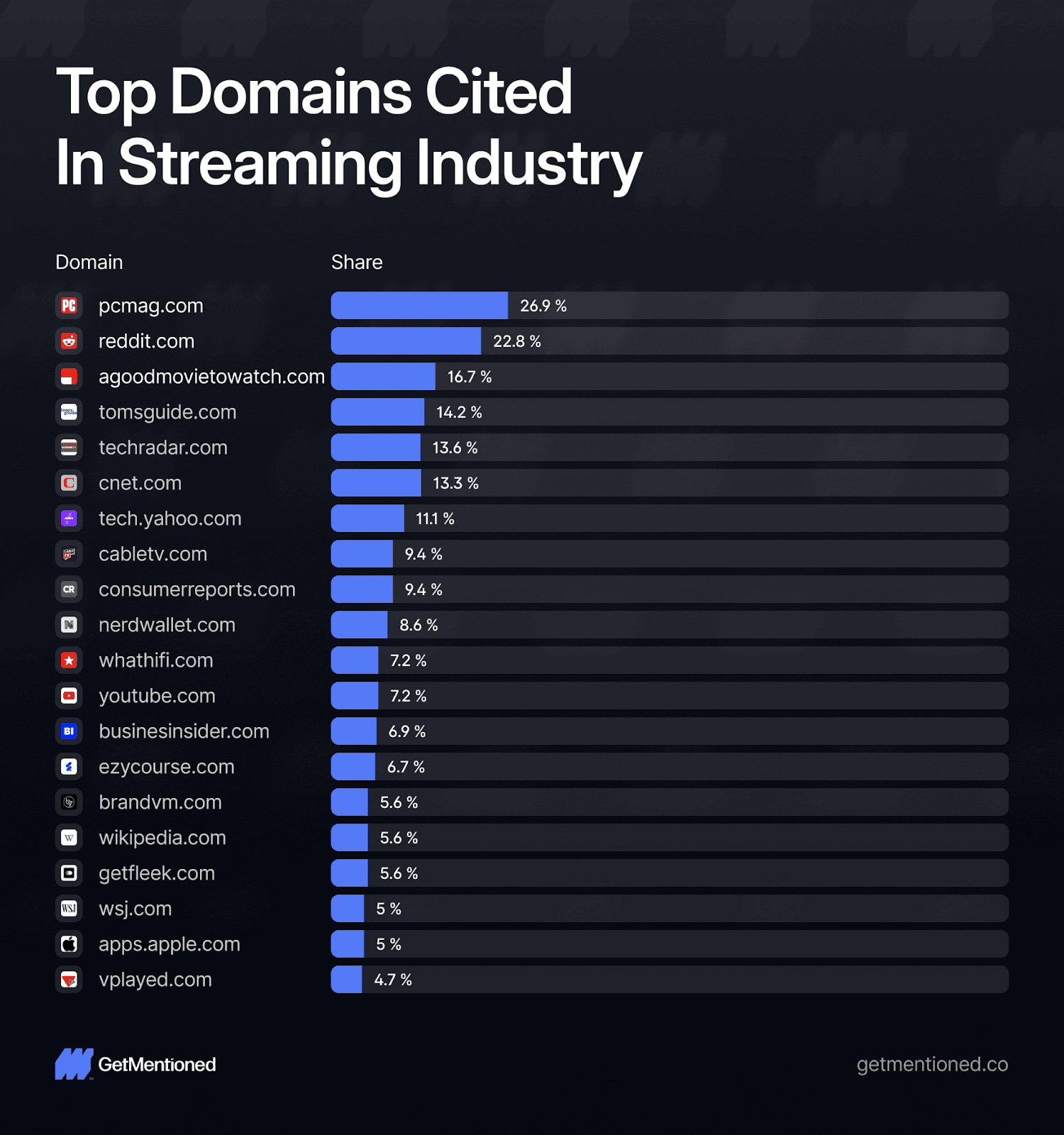

Top Sources Influencing AI Recommendations

Understanding which sources AI models cite when making streaming recommendations reveals where influence lies - and where streaming services should focus their PR and content strategies.

Source Rankings

Source Analysis

Tech publications dominate AI citations. The top four non-Reddit sources are all technology review sites (PCMag, Tom's Guide, TechRadar, CNET), collectively appearing in over 65% of AI responses. AI models heavily weight expert editorial content when making streaming recommendations.

Reddit commands significant influence. With 45 unique URLs cited (more than any other source), Reddit demonstrates the power of authentic user discussions in shaping AI recommendations. AI models value crowd-sourced opinions and real-world experiences.

Niche content sites have outsized influence. Agoodmovietowatch.com, a relatively small site focused on content recommendations, ranks #3 at 16.7% - higher than major publications like CNET. AI models value specialized expertise.

YouTube serves dual roles. YouTube appears as a cited source but is also flagged as a "Competitor" in the data. This dual role - both a source of information about streaming services and a competitor for viewing time - creates a unique dynamic.

Wikipedia provides foundational information. Despite lower usage percentage (5.6%), Wikipedia has the second-highest URL count (22), indicating AI models draw from many different Wikipedia pages for baseline information.

Strategic Implications

For streaming services seeking to improve AI visibility, this source analysis suggests:

Prioritize tech publication coverage - positive reviews and features on PCMag, Tom's Guide, and TechRadar directly influence AI recommendations

Engage authentically on Reddit - community discussions carry significant weight

Target niche streaming content sites - their specialized authority translates to AI influence

Maintain comprehensive Wikipedia presence - accurate, detailed Wikipedia content serves as baseline information for AI models

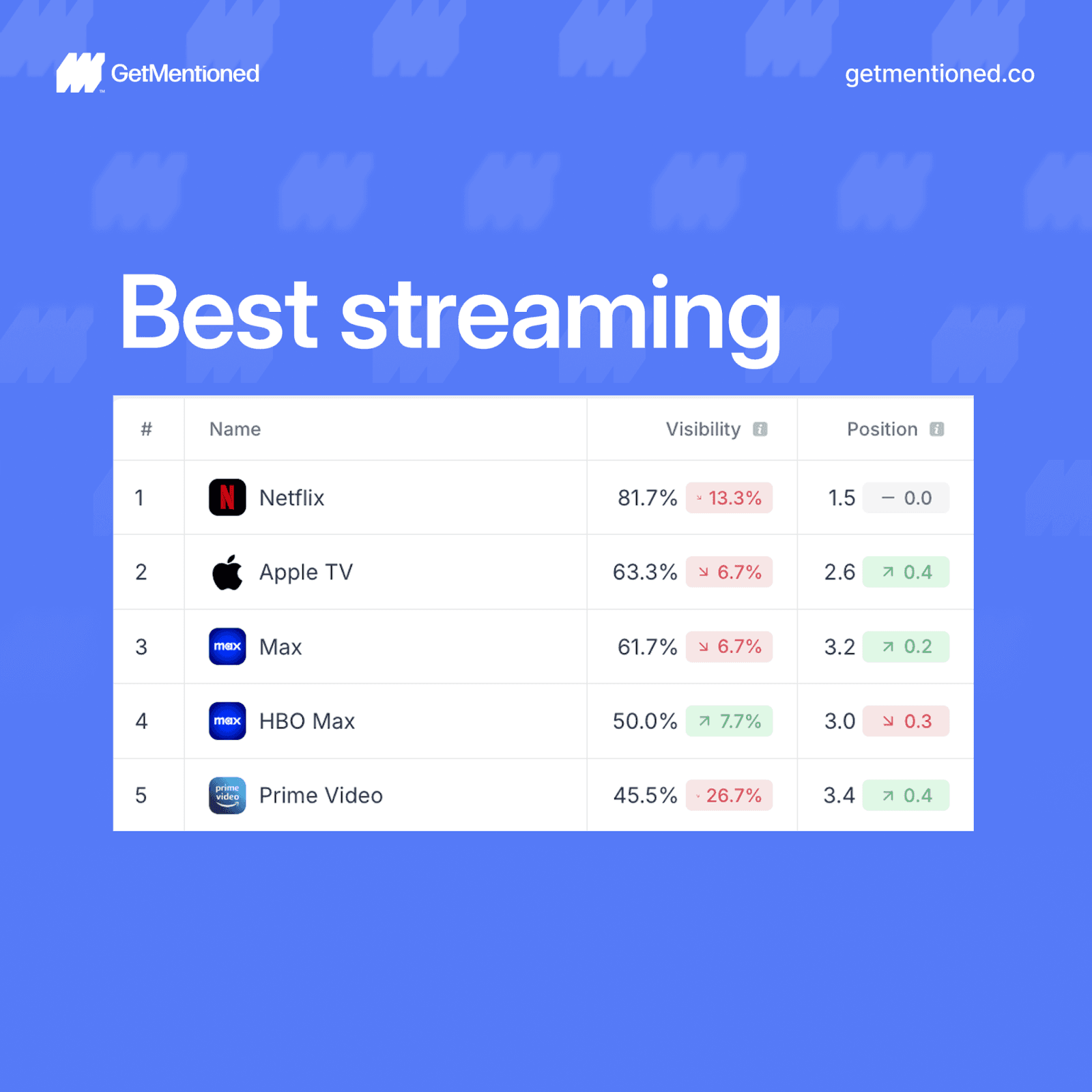

Topic Analysis: "Best Streaming Service"

When consumers ask AI assistants which streaming service is "best," the results differ notably from overall visibility rankings.

Rankings for "Best Streaming Service"

Key Insights

Netflix's "best" positioning exceeds its overall visibility. At 81.7% visibility (vs. 69.7% overall), Netflix is even more dominant when the specific question of "best" is asked. AI models strongly associate Netflix with quality leadership.

Apple TV dramatically outperforms its overall ranking. Jumping from #5 overall to #2 in "best streaming service," Apple TV's premium positioning translates to strong quality perception. Despite smaller library size, AI models associate Apple TV with quality content and user experience.

Prime Video ranks lower for "best" than overall. Dropping from #2 overall to #5 in "best" with 45.5% visibility, Prime Video appears to have weaker quality perception despite strong overall presence.

HBO Max appears separately from Max. Both the legacy "HBO Max" brand and the new "Max" brand appear in rankings, with HBO Max at 50.0% visibility and a better average position (3.0) than Max (3.2).

Hulu absent from top 5. Despite ranking #3 overall, Hulu doesn't appear in the "best streaming service" rankings - a significant perception gap.

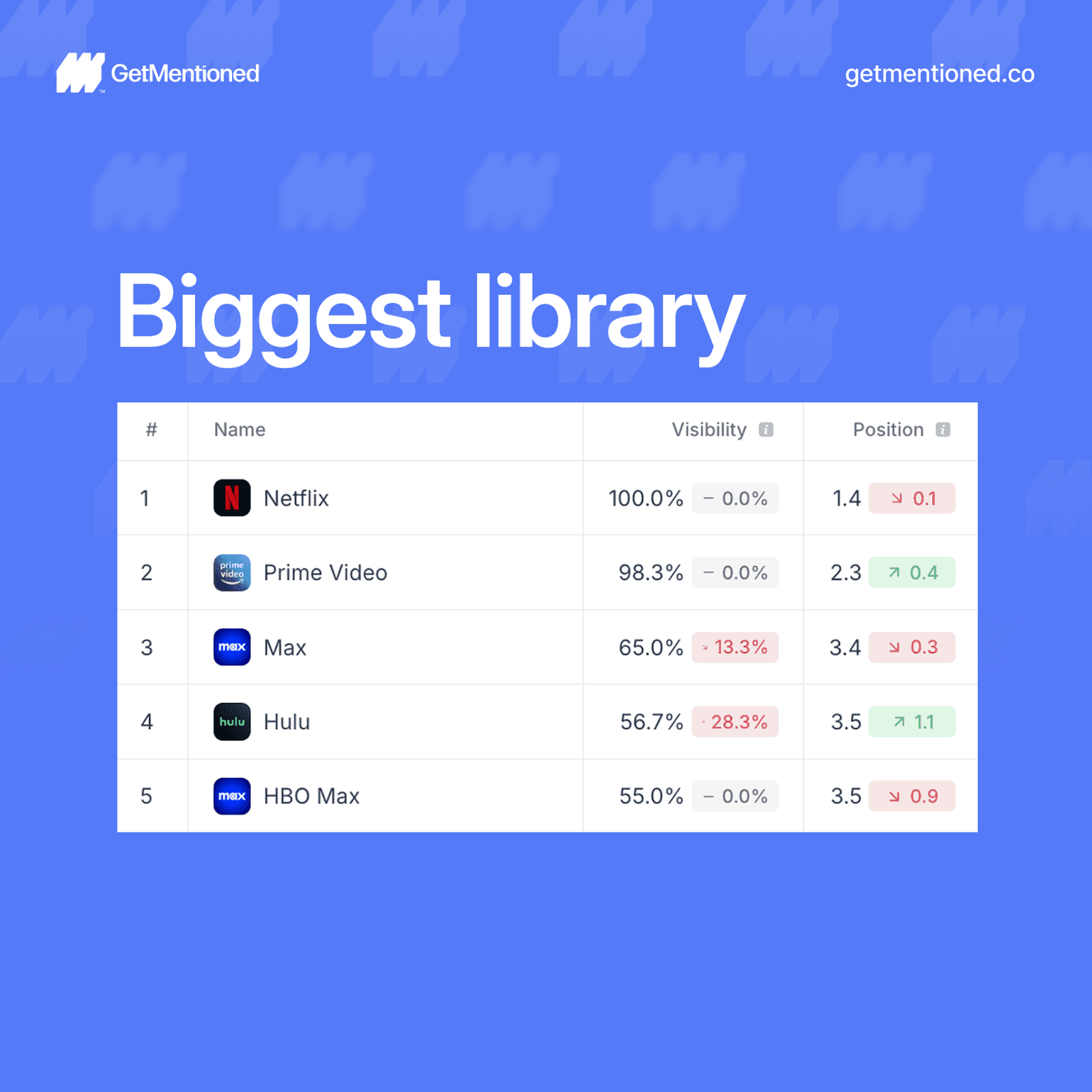

Topic Analysis: "Biggest Content Library"

Content volume is a major decision factor for many subscribers. Here's how platforms perform when consumers ask about library size.

Rankings for "Biggest Content Library"

Key Insights

Netflix achieves perfect visibility. At 100% visibility, Netflix appears in every AI response about content library size. This is the strongest category performance of any platform across all categories analyzed.

Prime Video nearly matches Netflix. At 98.3% visibility with 2.3 average position, Prime Video's massive catalog is well-recognized. Netflix and Prime Video form a clear "Big Two" for content volume.

A dramatic gap exists below the top two. The 33+ percentage point gap between Prime Video (98.3%) and Max (65.0%) demonstrates how decisively AI models distinguish between the volume leaders and everyone else.

Apple TV notably absent. Apple TV doesn't appear in the top 5 for content library size, reflecting AI models' accurate understanding of Apple's "quality over quantity" strategy.

Hulu and HBO Max cluster together. Both platforms sit at approximately 55-57% visibility with identical 3.5 average positions, suggesting similar content volume perception.

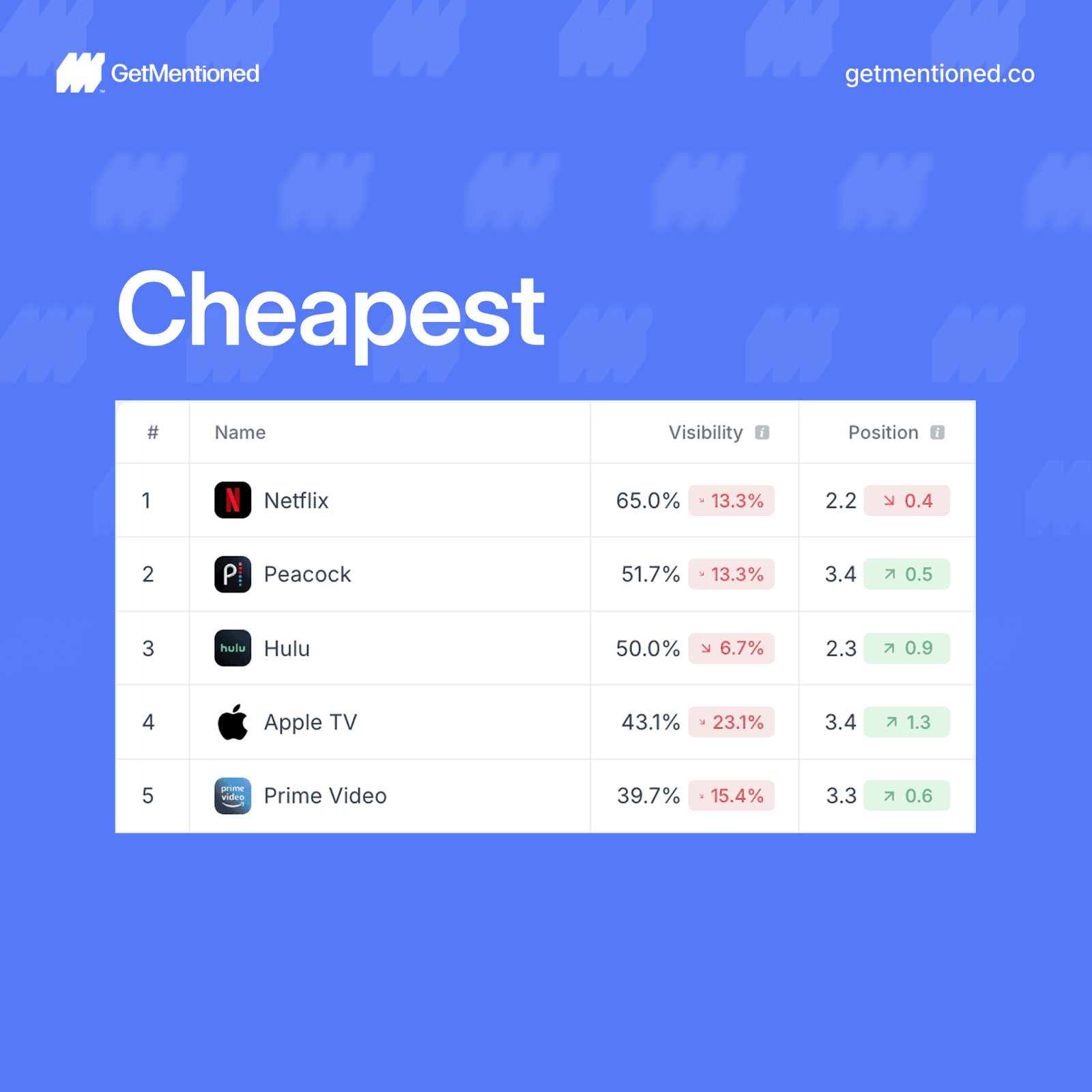

Topic Analysis: "Cheapest Streaming Service"

Price sensitivity drives many subscription decisions. Budget-focused queries reveal a completely different competitive landscape.

Key Insights

Peacock enters the rankings. Appearing for the first time in our category analysis, Peacock's budget-friendly positioning resonates with AI models for price-focused queries. NBCUniversal's free tier strategy is reflected in AI recommendations.

Netflix leads but with diminished dominance. At 65.0% visibility (vs. 69.7% overall) and 2.2 average position (vs. 1.5 overall), Netflix's presence weakens for budget queries. AI models recognize Netflix isn't the cheapest option.

Hulu achieves strong positioning. At 2.3 average position (#3 visibility but #2 in positioning), Hulu is frequently mentioned near the top of AI responses about cheap streaming, indicating strong budget positioning.

Max is notably absent. Despite ranking #4 overall, Max doesn't appear in the "cheapest" top 5 - AI models don't associate Max with budget streaming.

Prime Video ranks last. At 39.7% visibility and 3.3 position, Prime Video's inclusion with Amazon Prime membership doesn't translate to "cheap" perception in standalone streaming queries.

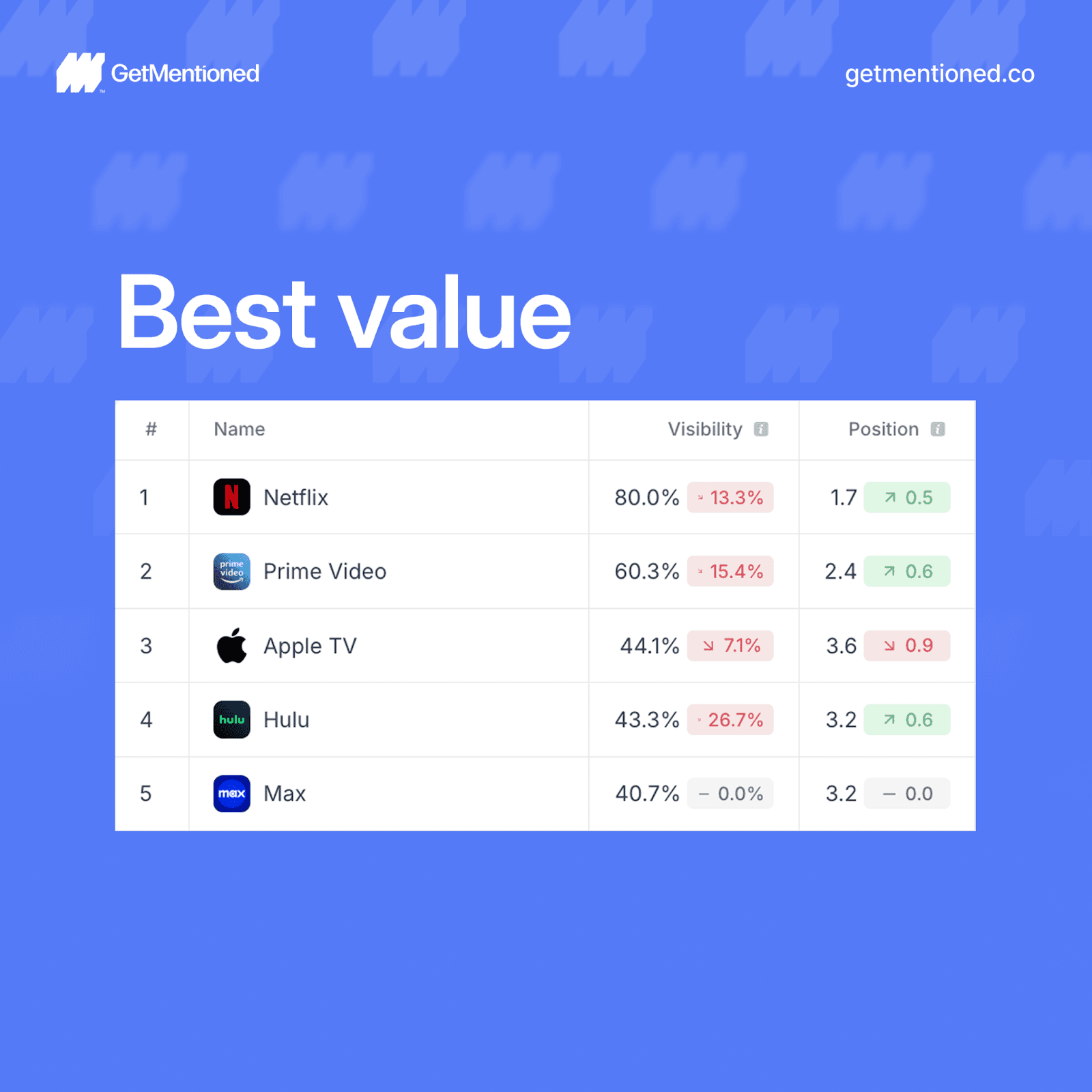

Topic Analysis: "Best Value Streaming"

"Best value" differs from "cheapest" - it implies optimal quality-to-price ratio rather than lowest price alone.

Rankings for "Best Value Streaming"

Key Insights

Netflix dominates "value" perception. At 80.0% visibility and 1.7 average position, Netflix's brand strength overcomes its higher price point. AI models view Netflix as providing strong value despite not being the cheapest option.

Prime Video's bundling advantage shows. At 60.3% visibility and 2.4 position, Prime Video benefits from its inclusion with Amazon Prime membership in value assessments.

"Value" rankings more closely mirror overall rankings than "cheapest" does. Netflix and Prime Video lead both overall and value categories, suggesting AI models understand the distinction between price and value.

Peacock disappears from "value" despite appearing in "cheapest." This reveals AI models' nuanced understanding - cheap price doesn't automatically equal good value.

Hulu has better positioning than visibility suggests. At 3.2 average position vs. Apple TV's 3.6, Hulu ranks higher when mentioned despite lower visibility (43.3% vs. 44.1%).

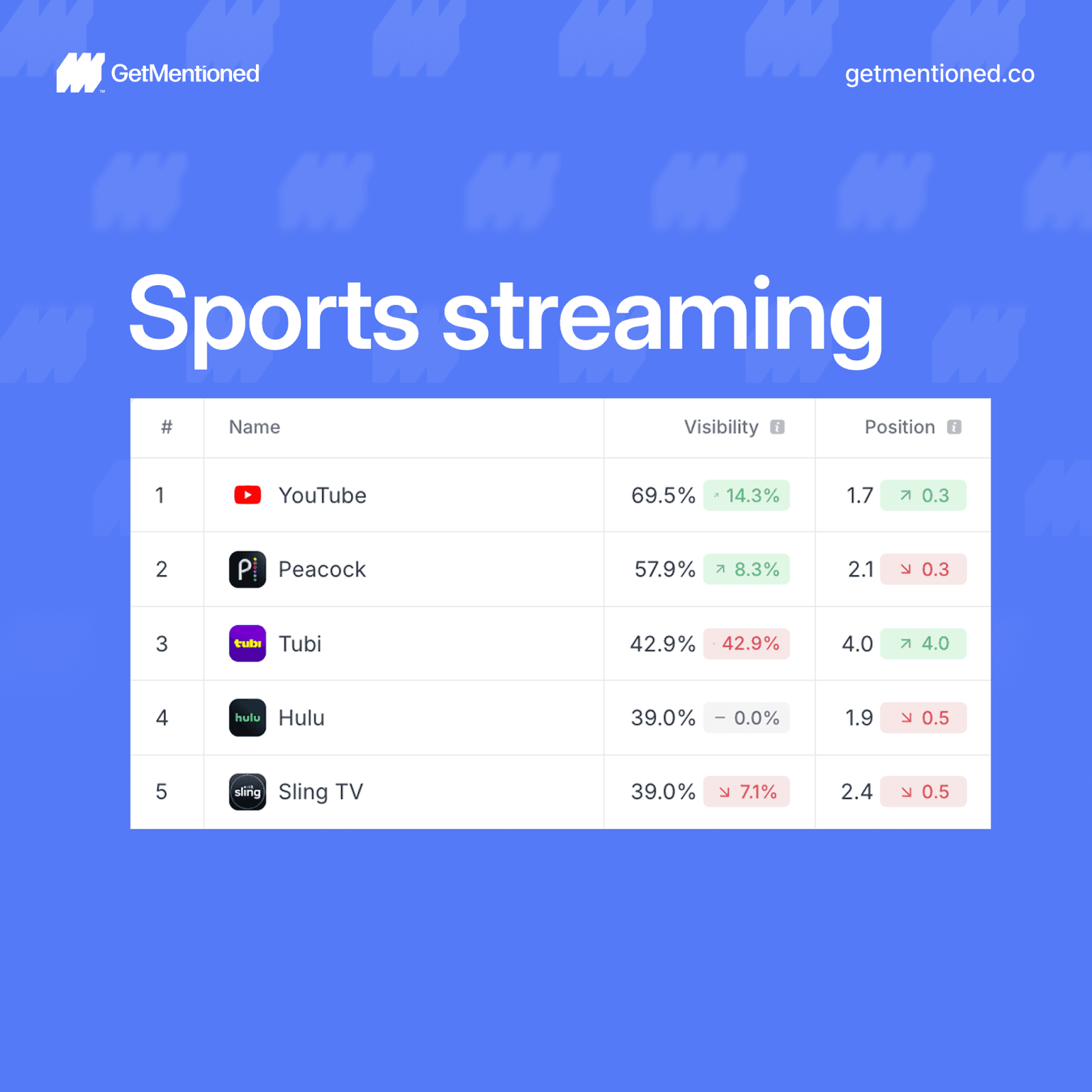

Topic Analysis: "Sports Streaming"

Sports content is increasingly important to streaming strategy. This category reveals a completely different competitive set.

Rankings for "Sports Streaming"

Key Insights

Traditional streaming leaders disappear entirely. Netflix, Prime Video, Max, and Apple TV - the dominant players in other categories - don't appear in the sports streaming top 5. AI models clearly understand that sports content requires specialized services.

YouTube emerges as the sports streaming leader. At 69.5% visibility with 1.7 average position, YouTube TV (and YouTube's sports content) dominates AI recommendations for sports streaming.

Peacock claims strong sports positioning. At 57.9% visibility and 2.1 average position, Peacock's investment in live sports (NFL, Premier League, Olympics) translates to strong AI visibility.

Specialized services enter the conversation. Sling TV appears for the first time at 39.0% visibility, reflecting its live TV and sports focus.

Hulu has the best average position. Despite ranking #4 in visibility (39.0%), Hulu has the best average position (1.9) in this category. When AI models mention Hulu for sports, they rank it highly.

Tubi has visibility but poor positioning. At 42.9% visibility but 4.0 average position, Tubi is mentioned frequently but ranked low when it appears.

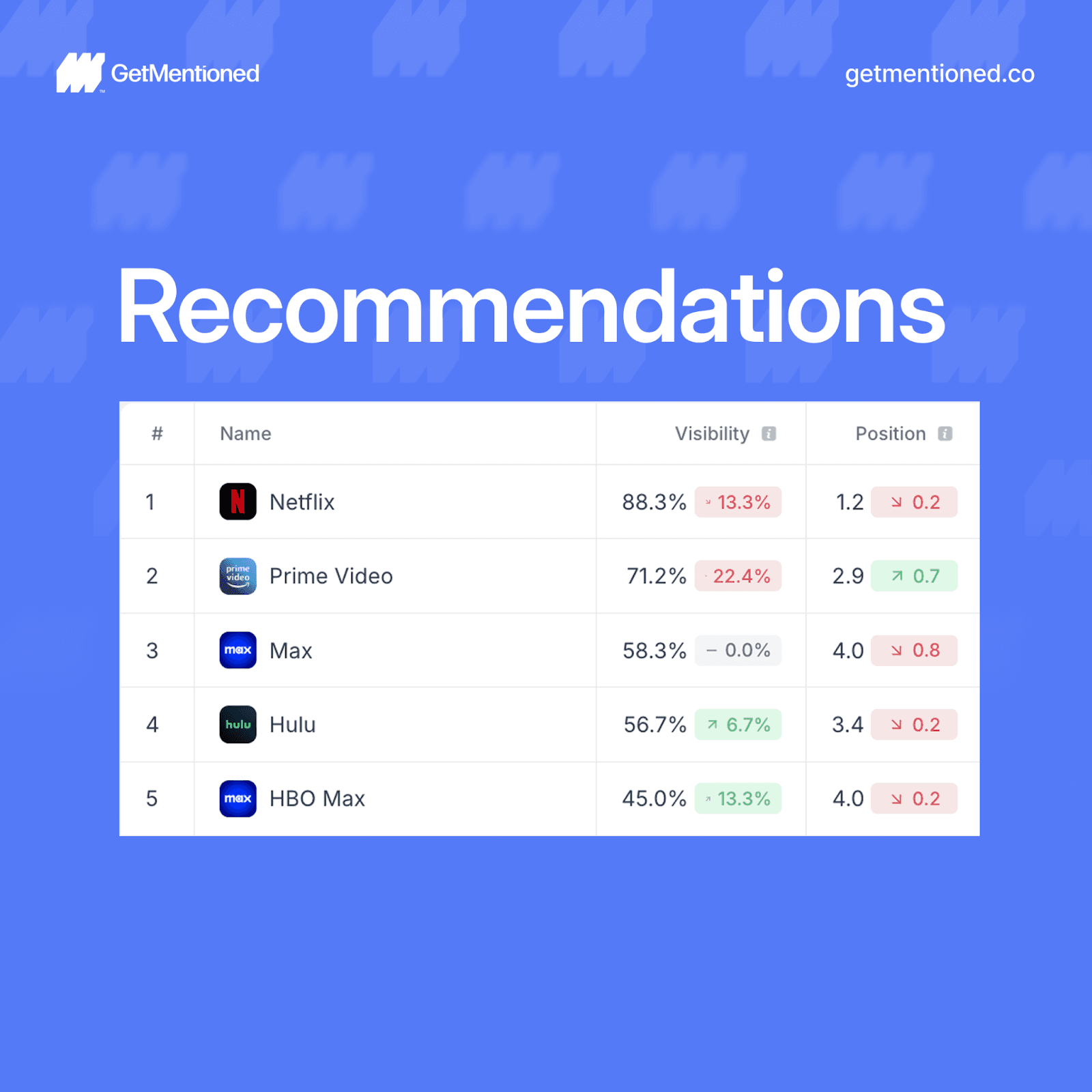

Topic Analysis: "Best Platform Recommendations"

This category evaluates how platforms perform when consumers ask about recommendation quality and personalization.

Rankings for "Best Platform Recommendations"

Key Insights

Netflix achieves its best average position across all categories. At 1.2 average position, Netflix is almost always mentioned first when AI discusses recommendation algorithms. Netflix's pioneering work in personalization has created strong AI perception.

Netflix's recommendation reputation exceeds its overall visibility. At 88.3% visibility (vs. 69.7% overall), Netflix significantly over-indexes for recommendation quality.

Prime Video maintains second position. At 71.2% visibility and 2.9 average position, Prime Video's recommendation engine is well-recognized but trails Netflix substantially.

Hulu outperforms Max in positioning. Despite similar visibility (56.7% vs. 58.3%), Hulu has significantly better average position (3.4 vs. 4.0).

Apple TV notably absent. Despite strong "best streaming service" performance, Apple TV doesn't appear in the recommendation algorithm top 5.

Brand split visible in Max/HBO Max. Both "Max" and "HBO Max" appear separately, suggesting AI models haven't fully consolidated the rebrand in their responses.

7-day free trial

Setup in 5 minutes

No credit card required